The Ethereum Foundation Foundation (EF), a non -profit organization responsible for the development of blockchain, intersects one of its most fierce phases so far.

Crisis management In Ethereum Foundation

Removal of leadership, internal conflicts, and controversial investment of $ 165 million in Defi raised concerns about Ethereum’s administration and neutrality. These fights fall at a critical moment. The crypto market is evolving, and new candidates appear as serious challenges to position Ethereum as the second largest cryptocurrency.

Vitalik Buterin has recently confirmed restructuring within the Ethereum Foundation Foundation to solve long -term problems concerning the management of public affairs. This generation was motivated by several controversies, especially the scandal of its own scandal; Two scientists from the Foundation Ethereum Foundation, Justin Drake and DanCrad Feist have taken the role of very lucrative advisors with their own education.

“What does the EF contributor do when he accepts roles for projects with contradictory incentives with Ethereum? Where there is a credible neutrality, ”Emon, a user known at X. joked.

Eigenlayer, the remaining protocol, allows its users to use their liquid share in other networks. In addition to the more efficient capital, this protocol raises concerns about the Ethereum safety model. When Crypto Cobie Trader revealed that Drake and Feist had received millions in Eigenlayer chips, the community made its indignation.

Indeed, critics perceived this as an apparent conflict of interest, Ethereum initiators benefited from their influence on the development of the protocol. The scandal finally pushed the Ethereum Foundation to introduce a formal conflict of interest in May 2024.

Drake has finally resigned from Eigenlayer, but the credibility of Ethereum has already been stained. Many wondered whether scientists and officials Ethereum were credible and questioned their desire to act in the best interest in the network rather than for their financial profit.

Investing in defines $ 165 million

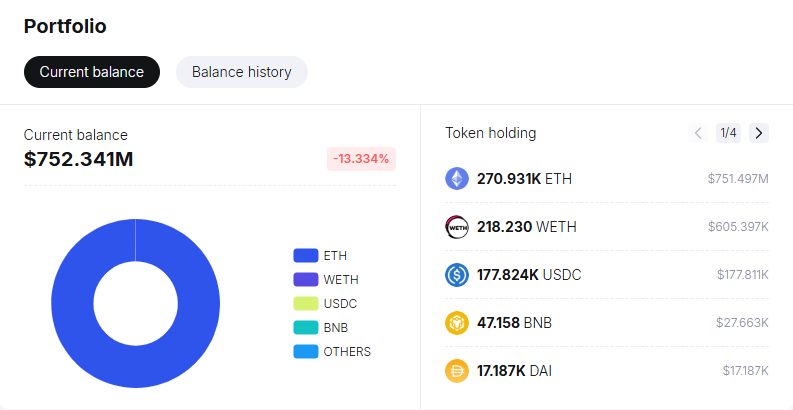

In parallel with its own issue, Eigenlayer, the Ethereum Foundation Foundation made another surprising decision by starting 50,000 ETH (approximately $ 165 million) in deficit. The aim of this initiative was to reconstruct the EF Treasury, which has decreased by 39 %in the last three years. The foundation allocated these funds through the portfolio of more signed 3-sur-5 and put them in loan protocols like Aave and Lido.

According to Spotonchain data, the treasure of EF had $ 752 million when writing this article.

For years, the Ethereum Foundation has avoided Staker for years for concerns about regulatory risks and network neutrality. However, with the course of ETH in half the mast against bitcoin, while the ecosystem Ethereum loses the land in terms of the activity of the developers and activities of users and the market share, EF decided to accept a more aggressive financial approach.

Some perceived this approach as a strategy to create a passive income, while others think it shows a certain despair in the face of Ethereum’s domination.

Debate on gas limits: scaling At the expense of security?

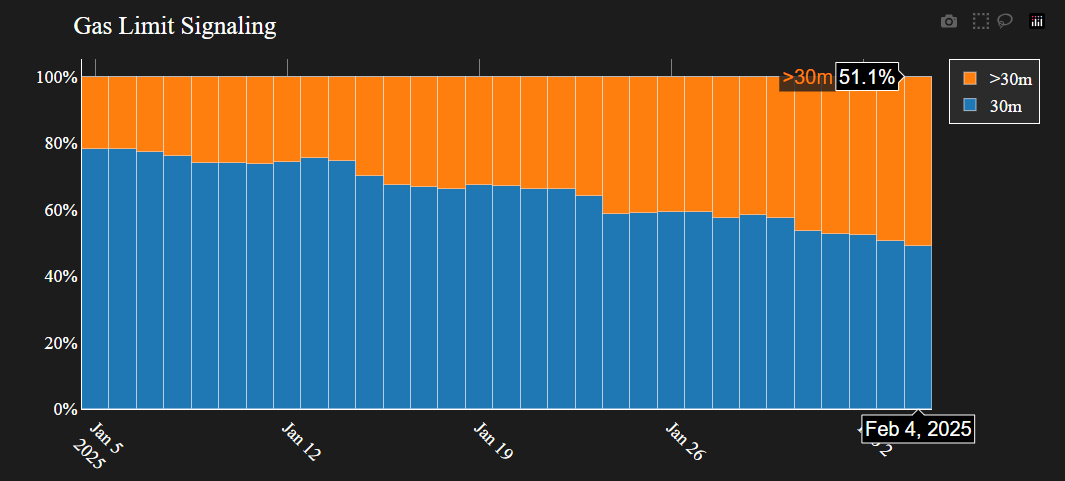

In parallel, Ethereum is currently the core of another major debate on the increase in its gas limit. Indeed, the Ethereum gas limit has exceeded 32 million, which is nearly 52 % of netidators of network, which expressed their support for increasing.

The argument would be as follows: the increase in the gas limit would reduce transaction costs and streamline the network.

“It will be the first increase under the proof.” Knowing that POS is much more decentralized than outdated technologies like Pow, it took more time to coordinate. Who will be a hero to make us cross the course, ”wrote X Evan Van Ness, former director of the Consensy operations.

However, this approach is not unanimous. Critics on their part fear that too aggressive increase in the gas limit could destabilize the Ethereum network. According to them, this would make it difficult to participate in small validators, which could lead to greater centralization.

Co -founder of Ethereum, Vitalik buterin, preaches Pectra Fork, which promises better usability of the network, which promises better usability of the network.

“… I think we should also vote on the goal of” blob “stakes so that he can increase without delay in response to technological improvements” shared buterin on X.

While the Ethereum is already fighting the risks of the remaining, conflict of interest and disputes in the field of public administration, this gas limit debate only strengthens the uncertainty about the future of this blockchain.

Ethereum faces competition: Altcoin n ° 1 endangered

With the lack of ETH performance compared to other assets, investors are exploring competitors who are able to detrize it from his position Derrière Bitcoin in the classification of crypto. For example, Solana has experienced a strong revival, attracted developers and users due to low cost and high speed transactions. However, Juan Pellicer, the main analyst of Intotheblock, explains that Solana has a long way to be able to Dethrone Ethereum Dethrone.

“Although Solana can continue to grow and potentially exceed Ethereum in specific niches, it is unlikely to overcome the well -established Ethereum position as a dominant platform in the near future, even if the competitive landscape turns out to be dynamic and evolving,” explained Pellicer Beincrypto, exclusive interview.

In part, they also obtain an intelligent binance chain (BSC), avalanche (AVX) and even modular blockchain solutions such as Celestia (TIA), soil. In this context, the question is no longer a question whether Ethereum will remain a dominant platform of intelligent contracts. It would be a question to know if this altcoin can maintain its second largest cryptocurrency position.

If Ethereum continues to solve management and scalability problems, while competitors offer better efficiency and user experience, its place on the market could be at risk.

Given that all this development should investors in 2025 are interested in Ethereum?

Despite its persistent problems, the Ethereum remains the most decentralized and mostly received by an intelligent contractual platform. Its solid ecosystem of the developer, its deep liquidity and established infrastructure give it the main advantage. Recent restructuring in terms of his leadership, conflict policy and cash management changes indicate that EF will take measures to repair his trajectory.

However, the risks are undeniable. Ethereum is a key moment in its history; His further actions will determine whether he can maintain his domination or whether the new leader will crush him on the market. Investors should carefully consider all these factors and assess the basic solids of Ethereum in the face of uncertainty surrounding its management and future development.

In any case, the Ethereum changes and the community must decide whether these changes will prove to be positive or indicate the beginning of its decline.

Data Beincrypto shows that ETH was negotiated at $ 2,664 at the time of writing, almost 2 % of the start of the session.

Morality History: The eternal second of the crypt remains only if it fights to go through the first.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.