The time dominated by speculative corners is now increasingly focused on high-tech altcoin projects with real useful and innovative blockchain solutions.

Investors turn to the Kryptos rwa and define

The Kaito AI Web3 information platform and the analysis of Krypto experts suggest that investors are becoming more and more The active real world (RWA), decentralized finances (defi) and advanced blockchain protocols.

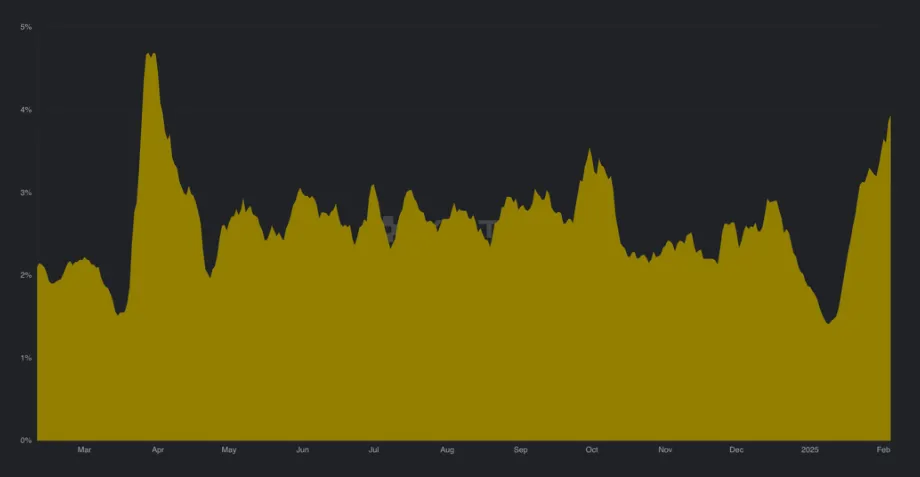

According to Kaito AI, interest in RWAS was reflected after the cavity reached 12 months in January. This recovery signals a renewed interest in the tokenization of the financial assets of the real world that attracted institutional actors.

Similarly, the defi has gained its place, even the IZ of the market interest has crossed the AI tokens. The defi revival indicates the transition to more resistant financial mechanisms that contrast with the speculative nature of the same corners.

Several blockchain projects have appeared as the main recipient of this change. Berachain (Bera) and Megaeth (Weth) have gained popularity. The Kaito AI analysis emphasizes these projects, such as the main winners in terms of market share.

For Berachain, however, social domination or consumer acquaintance is likely to be attributed to the recent AirDrop and the subsequent evaluation on Binance and Bitrue. In the Declaration Shared with Beincrypto, Bitrue also undertook to support developers on Berachain, a blockchain that introduces a unique consensual mechanism of evidence-clicking (POL), considered better evidence-stake (POS).

“To celebrate this important step, Bitrue reports two special events for Exchange users. First, Power Piggy: Bera will be available in Power Piggy, Flexible Investment Product Bitrue, 10 % APR from February 6 at 14:00. Second, deposit competition: users who put Bera on Bitrue can earn rewards based on their deposit amount, ”Bitrue said in Beincrypto.

Despite the enthusiasm, however, the course of Token was undergoing pressure downwards due to ardrop, which shows that speculative dynamics is still present.

In addition to Berachain, Megaeth, Initial and Monad, they caught attention on the market. These projects focus on technical progress in terms of scalability, effectiveness of defi and blockchain. The expert Defignas explained that this restored enthusiasm reflects the early cycle 2020/21. At that time, a significant madness aroused strong projects of essential technical innovations.

“Technically innovative launch will re -arouse madness … It is not only your brain Degen Monkey, who blindly rushes in the same corners or which is ecstatic for a new celebrical coin – your analytical skills and research can be re -put into action,” wrote Ignas.

Investors are now tirelessly immersed in the mechanisms of protocols, agricultural strategies and long -term sustainability than speculate without distinction after ephemeral trends.

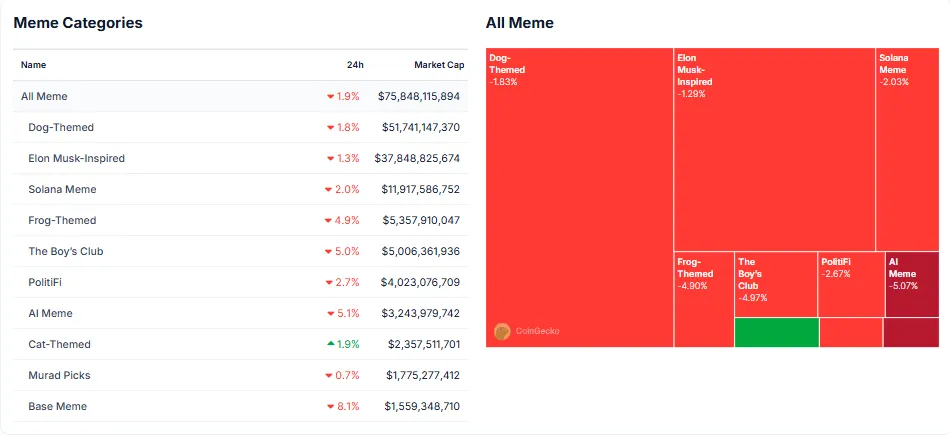

The same corners lose the soil, investors are looking for foundations solid

While the attention of investors turns away from the same corners, market capitalization of these assets decreases, while strong technical projects are more attractive. Previously, speculative enthusiasm around the same corners led to a short -term price assembly. Now their lack of basic innovations leads to a reduction in investors’ confidence.

The leader of Krypto Tarun Gupta recognizes this change of approach. It quotes real growth and innovations in protocols such as Fluid, Swing V3, Uniswap and Ondo Finance.

This ripening of the cryptom market suggests that investors are beginning to prioritize real applications and financial sustainability rather than short -term speculative trading. These observations also agree with recent Glassnode analyzes, suggesting that this change is not accidental, but rather a reflection of a more sophisticated investor base.

Today, private holders show a better understanding of blockchain technology and market changes than during previous market cycles. Rather than running around the same corners for quick profits, investors perform -atender research of emerging protocols. Projects also deal with initiatives in the field of administration of public and community buildings.

Moreover, industry observers, such as Ignas, emphasize that projects that reward the community’s commitment – such as Megaeth and Berachain – gain popularity. On the other hand, the same corner traders are often excluded from these incentives.

“It’s just me? We have always learned lessons on how to reward the community: Bera and Megaeth rewarded members of the community who contribute to value. This is true for supporting projects in the early phase via Testnet or simply chatting on X. Note how the same traders in the corner have not been included in the White/AirDrop list for one or the other? I also have the impression that those who were seriously affected by altcoins either sold what was left for Stabbenecins, or consolidated in rooms they really believe, ”Ignas added.

Despite this positive development, the transition to technically innovative altcoins does not guarantee the sustainable market stability. Although many investors move towards university projects, the crypto market remains volatile and influenced by a feeling. The market could also return to speculation at the same corners at any time, especially if the general macroeconomic conditions become unfavorable.

In addition, although defined and tokenization of real assets (RWA) gain popularity, problems remain in terms of regulation, safety and scalability. Investors must always carry out their own research.

Morality of History: After the storm of the same corners, the peace of RWA.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.