- Consensys has been debated twice under pressure from the US authorities, which illustrates the size of the Chokepoint 2.0 operation aimed at excluding crypto companies from the banking system.

- Wells Fargo would undergo pressure to close the Consensys account, even if it tried to postpone this decision and expressed its support from the company.

- Donald Trump’s elections have resulted in an opportunistic turnover, and some banks seem to predict a regulatory climate more favorable for crypto.

Blockchain Giant caught as a goal

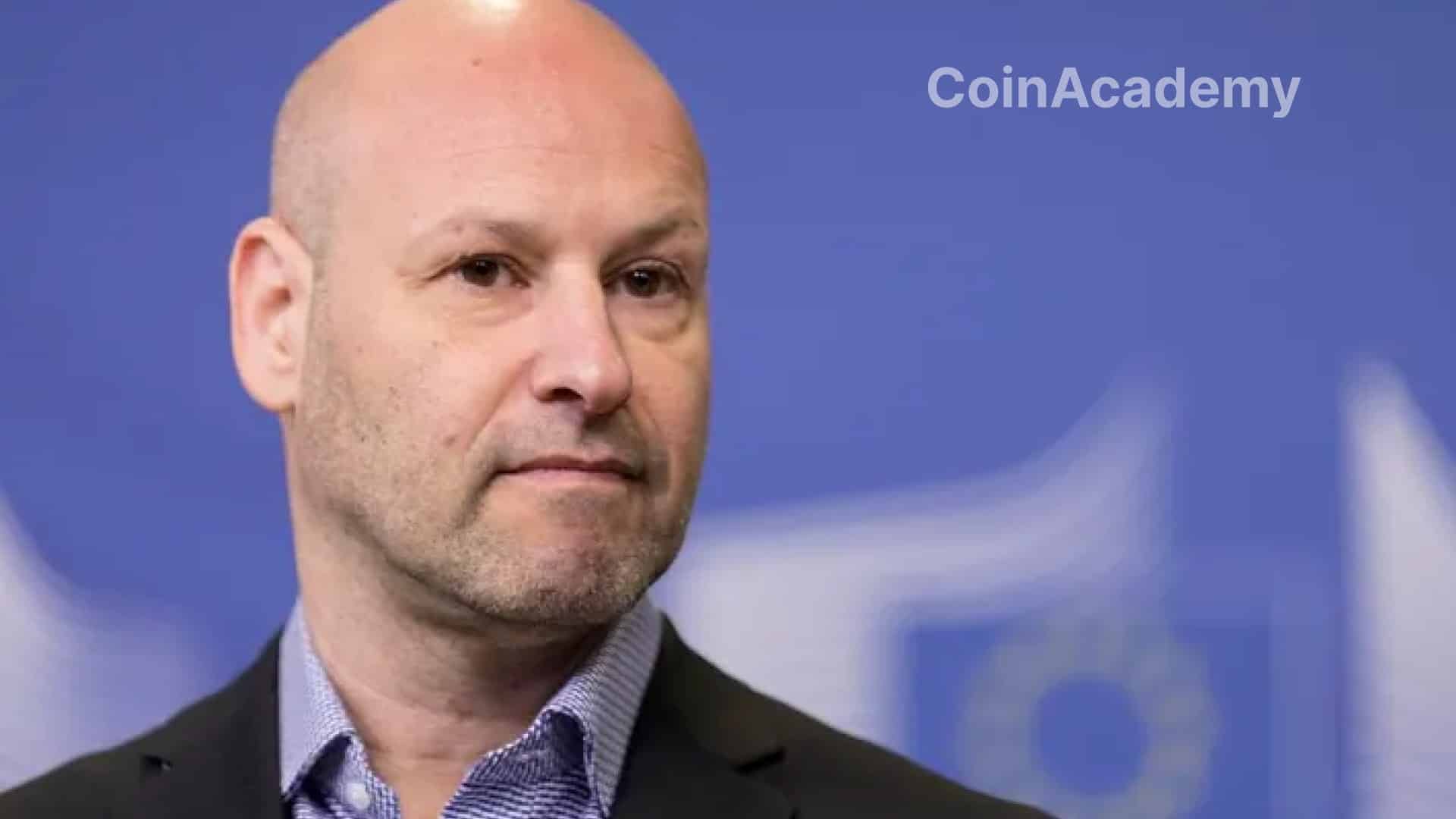

Joe lubinCeo Consensusrevealed that his business was twice under pressure from US authorities. Despite the resistance of his bank during the last episode, the regulatory offensive was finally for their relationship. This story illustrates the scope Chokepoint 2.0 surgeryAn informal initiative aimed at excluding crypto companies from the traditional banking system.

Blockchain Giant, known for your wallet MetamaskThanks and thanks and Redundant Bank Account Strategyguaranteeing the continuity of its activities despite these pressures. Lubin, he personally targetedIt attracts a disturbing table of methods used by regulatory organs.

Growing pressure on American banks

The last episode of this confrontation included a Big American bankWhich, according to a source of a close file, was Wells Fargo. The latter would resist as much as possible before giving up the pressures developed by the regulators within the biden administration.

The bank told us that it had suffered tremendous pressure to close our account. We are a company of $ 7 billion, always an excellent customer for them.

They told us, “We appreciate you, we don’t want to do it. We delay and warn the process as much as possible if we have to act.

Joe lubin

This episode resembles the first versionChokepoint surgerylaunched under Obama’s administration For to limit access to banking services of some industries considered politically sensitiveLike wage creditors and firearms dealers. Today, the crypto industry is facing this systematic exclusion.

Growing role of crypt in political debate

While the procedures of crypto debanization become burning In the United States, several influential persons in this sector, including Marc Andreessen (A16z) A Brad Garlinghouse (Waves)They publicly condemned these tactics. The question now examines CongressMarking a turnover point in the battle of the sector’s recognition and regulation.

The Reversal It also had an unexpected impact in November. The day after the vote, the bank official restored contact with Consensy surprisingly.

The day after the election, the bank turned to our financial team and asked, “Hey, would you like to look at the basketball game?”

This apparently harmless gesture could indicate a Change of opportunistic attitudeSome financial institutions expecting a regulatory climate more favorable to crypto under the Republican administration.

Precedent worrying for industry

Before this episode with Wells Fargo,, Lubin was already facing a The first wave of debanizationPerformed in an even more brutal way by another bank whose name did not reveal. His personal account and an account of Consensys were closed without a detailed explanation, simply accompanied and letter.

This repeated eviction underlines and fragility For crypto depending on the traditional banking network. Because the control pressure intensifies, the need for alternative solutions – for example Stablecoins, Decentralized Finance (Defi) and Crypt Bank – It is becoming increasingly obvious.

CONSENSYS’s article reveals damage to ChokePoint operation: cancellation and pressure of the bank appeared on the Coin Academy for the first time